USCHO Fan Forum

-

The USCHO Fan Forum has migrated to a new plaform, xenForo. Most of the function of the forum should work in familiar ways. Please note that you can switch between light and dark modes by clicking on the gear icon in the upper right of the main menu bar. We are hoping that this new platform will prove to be faster and more reliable. Please feel free to explore its features.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

119th congress: must be at least 75 to chair a committee!

walrus

Wind up workin' in a gas station

Chinese battery tech is better, If by ours you mean Ford Chrysler GM then probably better but not something I see changing anyone's mind about going electric hereIs this about the Chinese Cars? I can at least understand that even if it is worthless. The sad thing is the Chinese Electric Cars are better than ours from what I hear...

FadeToBlack&Gold

Microlot Marxist

Now slotkin is letting her ass hang out. Man, bad week for Michigan politicians.

Slap Shot

I got nothing

I wonder (no not really of course they didn't) if they subtracted from the savings the costs to operate DOGE, cost for fired workers that were later rehired, lost productivity due to shortages in staffing...Now Muskrat says DOGE will only save $150 billion.

Meanwhile, estimates are DOGE cuts at the IRS will lower tax revenue collected by $500 billion.

Winning yet?

Handyman

Hug someone you care about...

Add Tesla to that but yes.Chinese battery tech is better, If by ours you mean Ford Chrysler GM then probably better but not something I see changing anyone's mind about going electric here

bronconick

Yep, still here

Gotta protect Detroit's $100k trucks and car payments near equal to mortgage prices. If the Chinese got to sell affordable EV's, it'll be like the Japanese selling cars in the 70's again.Now slotkin is letting her ass hang out. Man, bad week for Michigan politicians.

Handyman

Hug someone you care about...

Speaking of mortgages:

bsky.app

bsky.app

Catherine Rampell (@crampell.bsky.social)

Mortgage rates surge over 7% as tariffs hit bond market https://www.cnbc.com/2025/04/11/mortgage-rates-surge-tariffs-bond-market.html

FadeToBlack&Gold

Microlot Marxist

There are so many Boomers banking a large part of their retirement on houses they likely won't be able to sell at the price they need for long-term survival.Speaking of mortgages:

Catherine Rampell (@crampell.bsky.social)

Mortgage rates surge over 7% as tariffs hit bond market https://www.cnbc.com/2025/04/11/mortgage-rates-surge-tariffs-bond-market.htmlbsky.app

But hey, a majority of them voted for this!

FadeToBlack&Gold

Microlot Marxist

This isn't an ELI5, but it boils down to the balancing act between investment safety and risk. More demand for bonds (when the market is bearish) equals higher prices and lower yields. Mortgage rates are kinda-sorta tied to the 10-year Treasury note rate. So when those yields go down, mortgage rates tend to as well.

However, when the bond market is also turbulent, lenders will protect themselves from the uncertainty by keeping mortgage rates up and/or raising them higher. With the apparent flight of foreign capital from American investments, domestic investors are seeing lots of very negative signs. Therefore risk is skyrocketing and they're seeing that they may not have safe, reliable Treasury bonds to flee to like they usually do. Thus, increasing mortgage rates.

ELI5: By their actions which destabilize and devalue the USD, the Trump regime is making it more expensive for all of us to borrow.

However, when the bond market is also turbulent, lenders will protect themselves from the uncertainty by keeping mortgage rates up and/or raising them higher. With the apparent flight of foreign capital from American investments, domestic investors are seeing lots of very negative signs. Therefore risk is skyrocketing and they're seeing that they may not have safe, reliable Treasury bonds to flee to like they usually do. Thus, increasing mortgage rates.

ELI5: By their actions which destabilize and devalue the USD, the Trump regime is making it more expensive for all of us to borrow.

dxmnkd316

Lucia Apologist

I believe it’s tied to the 10-year because the average mortgage lasts about seven years historically speaking.This isn't an ELI5, but it boils down to the balancing act between investment safety and risk. More demand for bonds (when the market is bearish) equals higher prices and lower yields. Mortgage rates are kinda-sorta tied to the 10-year Treasury note rate. So when those yields go down, mortgage rates tend to as well.

However, when the bond market is also turbulent, lenders will protect themselves from the uncertainty by keeping mortgage rates up and/or raising them higher. With the apparent flight of foreign capital from American investments, domestic investors are seeing lots of very negative signs. Therefore risk is skyrocketing and they're seeing that they may not have safe, reliable Treasury bonds to flee to like they usually do. Thus, increasing mortgage rates.

ELI5: By their actions which destabilize and devalue the USD, the Trump regime is making it more expensive for all of us to borrow.

mookie1995

there's a good buck in that racket.

Fade says risk, he is implying spreads. There is always a spread between treasury bonds (risk free), then other types of fixed income instruments at the same time periods. With everyone going batshit crazy on potential recession or general uncertainty, the spreads will increase.

So even if rates fall, if corespondent economic uncertainty increases, mortgage rates won’t follow

So even if rates fall, if corespondent economic uncertainty increases, mortgage rates won’t follow

Kepler

Si certus es dubita

She says she will “lay down” at the border.

FadeToBlack&Gold

Microlot Marxist

She says she will “lay down” at the border. It’s “lie down,” dipshyt. Maybe think about improving education in your neck of the woods.

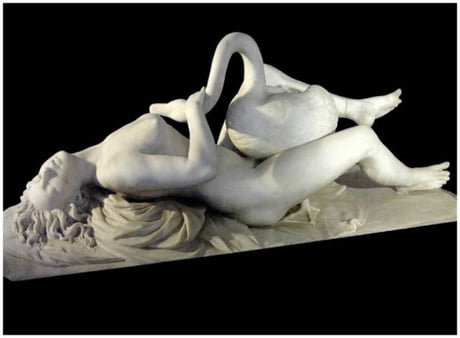

A sudden blow: the great wings beating still

Above the staggering girl, her thighs caressed

By the dark webs, her nape caught in his bill,

He holds her helpless breast upon his breast.

How can those terrified vague fingers push

The feathered glory from her loosening thighs?

And how can body, laid in that white rush,

But feel the strange heart beating where it lies?

A shudder in the loins engenders there

The broken wall, the burning roof and tower

And Agamemnon dead.

Being so caught up,

So mastered by the brute blood of the air,

Did she put on his knowledge with his power

Before the indifferent beak could let her drop?

Shit, Kep, it just occurred to me you are saying that Leda is laying "down." Damn. We are not worthy.

Last edited:

FadeToBlack&Gold

Microlot Marxist

Honestly, I should've figured out Slotkin a long time ago. IIRC, she lives on a farm in Holly/Fenton, which are basically lily white exurbs of Flint. My retarded second cousins live out there, where they run a fly-by-night pool business and a puppy mill. We don't speak much.