French Rage

NICKERSON HAS [CENSORED]

I'm inclined to agree to a point, but developers and architects aren't going away yet. With the gen AI available now, sure anyone can generate code that's dangerous. It might even work, albeit not efficiently and not necessarily following best practices. I'll admit I've used one of the AI models to generate some simple stub code to save time (like when I need to do a one-time cleanup of records). However, I have to tell it "follow best practice" to get it to include a statement that disables workflow execution, for example, so that I don't go spamming hundreds of people with automated emails that test or old records are updated or closed.

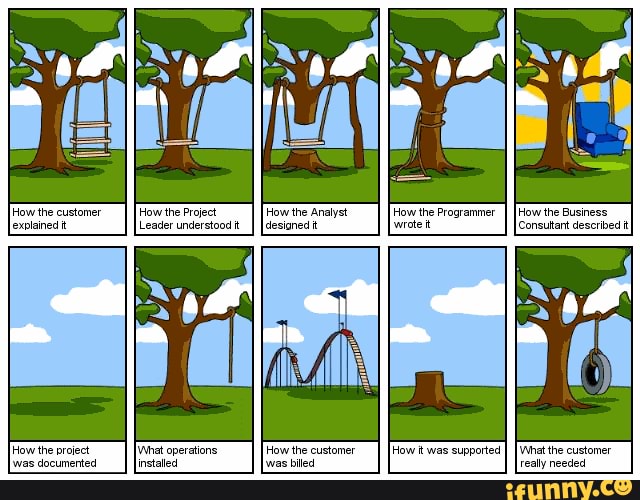

Generating great code still requires writing great specifications, and if people could do that they'd have fully automated it 20 years ago.