USCHO Fan Forum

-

The USCHO Fan Forum has migrated to a new plaform, xenForo. Most of the function of the forum should work in familiar ways. Please note that you can switch between light and dark modes by clicking on the gear icon in the upper right of the main menu bar. We are hoping that this new platform will prove to be faster and more reliable. Please feel free to explore its features.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Business, Economics, and Taxes: Eat Cereal for Dinner

- Thread starter MissThundercat

- Start date

Kepler

Cornell Big Red

Pix.

Brazil’s instant payment system works much like US payment apps like Zelle, but instead of being ruled by a consortium of banks it is controlled by the Brazilian Central Bank.

To access the payment system, one only needs to have a Brazilian bank account and an email address or a phone number. You can then register a personal or company Pix key using a taxpayer ID number (Brazil’s version of a social security number).

The whole country is operating on the system, for everything from buying groceries in a remote rural village to buying clothes in a shopping mall in Latin America’s biggest city of São Paulo.

You name it, everyone’s using Pix.

Benefits for the poor

The payment system is used by those from all income levels, with 159.9 million people registered at the end of June of 2025, according to Brazil’s Central Bank data.

“This has been the best thing the government has ever done for Brazil's poorest by far,” according to Márcio Garcia, an economics professor at Pontifical Catholic University of Rio de Janeiro.

“This has led to increased participation in the economy by poorer segments of the population, including opening bank accounts and becoming part of the banking system. It has become fundamental to the economic production of a lot of Brazilians today, given the size of the informal economy.”

Pix was launched in 2020 during the height of the Covid-19 pandemic, when many Brazilians opened bank accounts for the first time to receive government aid. They also quickly embraced the zero-contact Pix payment system.

Pix is used by 93 percent of adults in Brazil, with 62 percent naming it as their most frequently used payment method, according to a Google survey published by Valor in mid-July.

By 2024 Pix was already the most widely used payment method in the country, used by more than 76% of the population and surpassing both debit cards and cash (at around 69%), according to Brazil’s Central Bank.

US corporate giants not happy

But not everyone is thrilled. Two major US corporate interests – big tech and credit card networks – are losing market share to Pix.

Months before Pix launched, Facebook parent company Meta announced in 2020 that it would introduce WhatsApp payments in Brazil. But banking authorities delayed the rollout, arguing that it could undermine Brazil’s own payment systems. Meta eventually launched the WhatsApp payments system in May 2021 – six months after Pix entered the market – but it has since failed to gain traction. Some in the industry blame the decision to delay, citing the Brazilian government’s vested interest in the Pix programme.

The Office of the US Trade Representative (USTR) issued a statement in July announcing that it was investigating Brazil's “unfair trading practices”, saying that Brazil “may harm the competitiveness of American companies” by favouring its own innovative, government-developed electronic payment services, although it did not mention Pix by name.

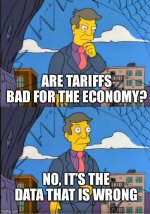

Against the backdrop of US President Donald Trump's threats to impose a 50 percent tariff on Brazil – which will now be implemented on August 1 – and calling for far-right former president Jair Bolsonaro's trial for his alleged coup attempt to be halted, the probe into trading practices seemed like another attack. A government-run social media campaign went viral with the slogan: “Pix is Ours, My Friend.”

“Seems like our Pix is causing a lot of jealousy abroad, you know?” the government said in an Instagram caption.

aparch

Well-known member

Interesting job numbers amirite

Aaron Rupar (@atrupar.com)

"It was not a good jobs number. It wasn't. The job market is softening. Our business people are creating fewer jobs" -- Republican Sen. John Kennedy

The hand waving required to make this dissappear would make mimes blush.

MichVandal

Well-known member

It's the fault of immigrants.

Seriously, that is exactly what they are going to say. That's one of the big excuses.

Kepler

Cornell Big Red

It's the fault of immigrants.

Seriously, that is exactly what they are going to say. That's one of the big excuses.

Biden. Or Obama. Or Hillary!

aparch

Well-known member

He figuratively shot the messenger.

rufus

rock and roller

Aaron Rupar (@atrupar.com)

"It was not a good jobs number. It wasn't. The job market is softening. Our business people are creating fewer jobs" -- Republican Sen. John Kennedybsky.app

The hand waving required to make this dissappear would make mimes blush.

But......but......we gave them all that money......

rufus

rock and roller

But they're getting rid of all the filthy immigrants that stole those jobs from hardworking patriotic Americans.It's the fault of immigrants.

Seriously, that is exactly what they are going to say. That's one of the big excuses.

Should be lots of available job openings for those Americans to step into. Hiring should be through the roof.

French Rage

NICKERSON HAS [CENSORED]

He figuratively shot the messenger.

Can't have bad jobs numbers if you don't count them!

Deutsche Gopher Fan

Registered User

If only they could grasp that interest rates are not why the job market is in fucking shambles

Slap Shot

I got nothing

Party of transparencyHe figuratively shot the messenger.

state of hockey

He fixes the cable?

Handyman

Hug someone you care about...

Can't have bad jobs numbers if you don't count them!

Deutsche Gopher Fan

Registered User

I did watch a bunch of veep episodes on the plane today.

Handyman

Hug someone you care about...

This is very very very bad. Some of us kept saying these numbers made no sense and the revisions flat out prove it. And it is only going to get worse because we still havent even hit the wall yet. As was predicted the summer was a bit better economically speaking because everyone stocked up before the tariffs hit but those supplies are dying out and demand is now at best stagnating (I would say it is damned near cratering) which means things are about to get real ugly...And of course this is what they wanted, what they said they were going to, what they tried to prepare their morons for by gaslighting them and are now getting. Trump will get his rate cut at least...

Unemployment ticked up (and will continue to) and now those people will have no access to Medicaid as well. (and other services)

I was just on a whiskey tour in Dublin...and they were talking about (without prompting) how Trump's tariffs are already strangling the distilleries and as the Reuters article says the European Market is not pleased.

Deutsche Gopher Fan

Registered User

It’s very very bad. And despite some people around here cheering that some of us are getting what we deserve, this ain’t good for the lower paying jobs either. No one wins except wealthyThis is very very very bad. Some of us kept saying these numbers made no sense and the revisions flat out prove it. And it is only going to get worse because we still havent even hit the wall yet. As was predicted the summer was a bit better economically speaking because everyone stocked up before the tariffs hit but those supplies are dying out and demand is now at best stagnating (I would say it is damned near cratering) which means things are about to get real ugly...And of course this is what they wanted, what they said they were going to, what they tried to prepare their morons for by gaslighting them and are now getting. Trump will get his rate cut at least...

Unemployment ticked up (and will continue to) and now those people will have no access to Medicaid as well. (and other services)

I was just on a whiskey tour in Dublin...and they were talking about (without prompting) how Trump's tariffs are already strangling the distilleries and as the Reuters article says the European Market is not pleased.

Suicides are going to go up. No jobs no services , no affordable places to live

Handyman

Hug someone you care about...

And lets not forget how AI is going to play into this going forward.It’s very very bad. And despite some people around here cheering that some of us are getting what we deserve, this ain’t good for the lower paying jobs either. No one wins except wealthy

Suicides are going to go up. No jobs no services , no affordable places to live

Deutsche Gopher Fan

Registered User

Yup. AI and offshoring were a big blow, now not knowing at all what your costs may be two weeks from now will add to the miseryAnd lets not forget how AI is going to play into this going forward.

Deutsche Gopher Fan

Registered User

The subs are in place. Maybe we don’t have to sorry about this stuff much longer