USCHO Fan Forum

-

The USCHO Fan Forum has migrated to a new plaform, xenForo. Most of the function of the forum should work in familiar ways. Please note that you can switch between light and dark modes by clicking on the gear icon in the upper right of the main menu bar. We are hoping that this new platform will prove to be faster and more reliable. Please feel free to explore its features.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Business, Economics, and Taxes: Eat Cereal for Dinner

- Thread starter MissThundercat

- Start date

St. Clown

Liberal Rebel Scum, apparently

I was reading that almost 20% of new car loans are >=$1,000/mo. payments. That’s likely why the rejections. Because a car payment shouldn’t be a mortgage payment.IS THAT GOOD DGF?? IT SEEMS LIKE THATS NOT GOOD.

(Higher than 2007 IIRC, right?)

dxmnkd316

Lucia Apologist

I'm sorry, what?I was reading that almost 20% of new car loans are >=$1,000/mo. payments. That’s likely why the rejections. Because a car payment shouldn’t be a mortgage payment.

That's literally as much as I paid for the mortgage (PIT+HOI) on my house 14 years ago. That's fucking bonkers.

aparch

Acetaminamerican

Welp, considering mortgages are in the 2500 to 3500/mo range for a median home...I was reading that almost 20% of new car loans are >=$1,000/mo. payments. That’s likely why the rejections. Because a car payment shouldn’t be a mortgage payment.

dxmnkd316

Lucia Apologist

I have no idea how that could be possible.Welp, considering mortgages are in the 2500 to 3500/mo range for a median home...

I'm paying less than 2000 for PIT+HOI on a 15-yr for a 5B, 2Ba

aparch

Acetaminamerican

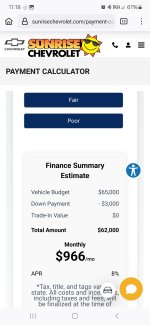

Ballparking tax/title/license and other financials, I spitballed 65k total, minus 3k down, 84 month loan, and "good" credit.I'm sorry, what?

That's literally as much as I paid for the mortgage (PIT+HOI) on my house 14 years ago. That's fucking bonkers.

Almost 1k a month.

5k down, 72/mo, and excellent is the same.

Attachments

aparch

Acetaminamerican

Just a random listing in my zip code.I have no idea how that could be possible.

I'm paying less than 2000 for PIT+HOI on a 15-yr for a 5B, 2Ba

Attachments

aparch

Acetaminamerican

I'm gonna need our financial experts to hold my hand while they explain if this is correct, or just some weird dots that shouldn't ever connect. I came across this TikTok video where someone claims that the next big "bank bubble" is really going to come from Pension Funds and other investments that purchase debt because venture capitalists and banks have figured out how to bundle up debt and push it through so they won't be left holding the bags of shit when the bubble bursts.

The key to this is "back floating rate loans." Private equity firms swoop in and buy up these businesses but saddle the business with the debt of the loan (which is common). These firms took advantage of the low loan rates for years, but were using variable rate loans. Banks package up these loans as good debt, the money from these profitable businesses will come rolling in to repay the debts, and sell them to pension funds where they can sit on the long term debt waiting for repayment.

And all this is, allegedly, about ready to burst and is going to absolutely decimate everything when it does.

So, finance experts, is this really where we're headed? Is this potentially bigger than the banks are too big to fail fiasco?

The key to this is "back floating rate loans." Private equity firms swoop in and buy up these businesses but saddle the business with the debt of the loan (which is common). These firms took advantage of the low loan rates for years, but were using variable rate loans. Banks package up these loans as good debt, the money from these profitable businesses will come rolling in to repay the debts, and sell them to pension funds where they can sit on the long term debt waiting for repayment.

And all this is, allegedly, about ready to burst and is going to absolutely decimate everything when it does.

So, finance experts, is this really where we're headed? Is this potentially bigger than the banks are too big to fail fiasco?

Russell Jaslow

Registered User

This whole HOA thing has gotten totally out of hand. The horror stories I have heard...$1000 a month in property taxes and HOA for a townhome? Hard pass.

But, that's a different subject.

Russell Jaslow

Registered User

My ignorant mind is thinking this sounds like what happened in the housing crisis of 2008. Mortgage debt constantly being sold off. One of the outcomes of that was nobody knew who held their mortgage anymore. There were cases where people no longer knew who they were paying off and even cases where their payments weren't counting against their mortgage. I remember some courts were stopping banks from repossessing homes because the banks couldn't prove they actually held the mortgage to that house.I'm gonna need our financial experts to hold my hand while they explain if this is correct, or just some weird dots that shouldn't ever connect. I came across this TikTok video where someone claims that the next big "bank bubble" is really going to come from Pension Funds and other investments that purchase debt because venture capitalists and banks have figured out how to bundle up debt and push it through so they won't be left holding the bags of shit when the bubble bursts.

The key to this is "back floating rate loans." Private equity firms swoop in and buy up these businesses but saddle the business with the debt of the loan (which is common). These firms took advantage of the low loan rates for years, but were using variable rate loans. Banks package up these loans as good debt, the money from these profitable businesses will come rolling in to repay the debts, and sell them to pension funds where they can sit on the long term debt waiting for repayment.

And all this is, allegedly, about ready to burst and is going to absolutely decimate everything when it does.

So, finance experts, is this really where we're headed? Is this potentially bigger than the banks are too big to fail fiasco?

St. Clown

Liberal Rebel Scum, apparently

My mortgage + escrow (taxes and insurance) is between $1,000 and $1,100, about 55% of the average mortgage payment in MN. I had a large downpayment, far exceeding the average. That said, I don’t know how most families get by each month because my wife and I both have above average incomes. We are far from rich, and purposefully chose a home under our budget so we could take an annual trip, pay for daycare now and private school later.I'm sorry, what?

That's literally as much as I paid for the mortgage (PIT+HOI) on my house 14 years ago. That's fucking bonkers.

ScoobyDoo

NPC

I had a one year increase of 1400 dollars for my Homeowners insurance this year. Everything is out of control, and as for the Wall Street discussion someone is making a lot of money out of it, and yes it will burst, and the bailout will be on the public dime.

Privatize the profits, socialize the losses. It's effectively the number one thing Government is supposed to protect us from, and instead it is the number one thing Government does.

Privatize the profits, socialize the losses. It's effectively the number one thing Government is supposed to protect us from, and instead it is the number one thing Government does.

D

Deutsche Gopher Fan

Guest

This is why I sold last year. Genuinely unsustainable on one income. I was paying 11k a year for just property taxes and insurance

dxmnkd316

Lucia Apologist

My mortgage + escrow (taxes and insurance) is between $1,000 and $1,100, about 55% of the average mortgage payment in MN. I had a large downpayment, far exceeding the average. That said, I don’t know how most families get by each month because my wife and I both have above average incomes. We are far from rich, and purposefully chose a home under our budget so we could take an annual trip, pay for daycare now and private school later.

For the first time since the year i bought my house, I had a create a budget because of daycare. I have no idea how people do it either. So much is getting cut just because of daycare.

And it's not like we were doing exorbitant travel or anything. We vacation in the upper peninsula. We do have the luxury of gopher hockey tickets, but those are stay GDit.

dxmnkd316

Lucia Apologist

If you aren't coming out ahead on home value compared to T+I, yeah, get out. You're losing money.This is why I sold last year. Genuinely unsustainable on one income. I was paying 11k a year for just property taxes and insurance

FadeToBlack&Gold

Microlot Marxist

I am at just under $7k/yr and that's pretty high for SE Michigan. However, I am in a very small suburb that takes a lot of pride in maintaining it's own schools despite declining enrollment and pressures to merge. We also have our own PD. So pretty much everyone under 40 here is paying a lot unless they bought at the bottom in 2010, or inherited their house.

Handyman

Hug someone you care about...

It is definitely happening...not much information though. Found some articles from last year about it but of course they were in a more positive light. S&P had a headline about how pension funds were lagging in their investment. This seemed to also include consumer debt as well btw...I'm gonna need our financial experts to hold my hand while they explain if this is correct, or just some weird dots that shouldn't ever connect. I came across this TikTok video where someone claims that the next big "bank bubble" is really going to come from Pension Funds and other investments that purchase debt because venture capitalists and banks have figured out how to bundle up debt and push it through so they won't be left holding the bags of shit when the bubble bursts.

The key to this is "back floating rate loans." Private equity firms swoop in and buy up these businesses but saddle the business with the debt of the loan (which is common). These firms took advantage of the low loan rates for years, but were using variable rate loans. Banks package up these loans as good debt, the money from these profitable businesses will come rolling in to repay the debts, and sell them to pension funds where they can sit on the long term debt waiting for repayment.

And all this is, allegedly, about ready to burst and is going to absolutely decimate everything when it does.

So, finance experts, is this really where we're headed? Is this potentially bigger than the banks are too big to fail fiasco?

(I am not a financial expert and have done little no research into the specifics but on the surface this is what I see)

I am loath to trust anything on Tik Tok but in theory yes, if this is really happening on the level they are suggesting it won't take much for things to go south badly. Private Equity these days is shady AF and we saw what happened when their big backer Silicon Valley Bank went under because of rate hikes. If the big banks started doing that on a massive scale the cascade effect could be deadly. If businesses that were purchased by Private Equity start failing not only are you dealing with much of the same issues the '08 crisis caused, but you are also adding in that hundreds/thousands of people will be out of work on tape of that. So you will have a spike in unemployment, consumer debt will skyrocket, homes will be lost, banks will be hit with defaults from both sides and likely even the Private Equity firms will get crunched because a lot of this will be underwritten by other investments (like how Musk used Tesla Stock as collateral for the Twitter purchase) or loans from banks that will be called due. Even if it is spread out over multiple quarters it will drag down the economy to a long term recession. If it all hits relatively quickly...well not to sound alarmist but it could literally destroy the financial sector and I am not being metaphorical.

Handyman

Hug someone you care about...

My SO loves to go on Zillow and look at homes when she is bored...the amount people are paying for homes is stupid. They will never get the value out of the house they are putting in unless they die in it. they are going to be "House Poor" the rest of their lives and even if they do sell they will almost be guaranteed to lose money on the sale too.I have no idea how that could be possible.

I'm paying less than 2000 for PIT+HOI on a 15-yr for a 5B, 2Ba

Which is why Private Equity buys a ton of it up to use as rentals and Air BnB. The more they do that the more prices rise...and you get the idea.